When you are a new driving instructor, or are a trainee, you may find it difficult to work out how many hours you need to work to make a living. You need to pay the mortgage or rent, pay the bills, have enough money to eat. And then you’ve got to factor in your business expenses.

That’s relatively easy with a calculator and a notepad. But what about tax and national insurance? How do you factor that in to your calculations?

To help you, there is a free Excel spreadsheet which lets you work it out.

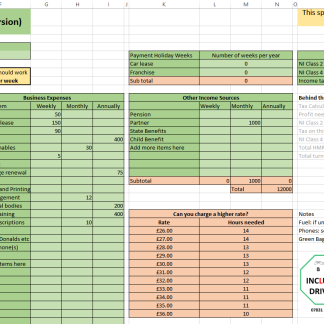

Enter your living expenses in the left hand columns. It doesn’t matter if they are weekly, monthly, or yearly: the spreadsheet will do the maths for you.

Then enter your business expenses in the same way. The spreadsheet is pre-filled with common items such as car lease, fuel etc but you can also add your own.

From there, the spreadsheet will perform some calculations on your living expenses and business expenses. Then it will estimate your tax bill for the year, look at your hourly rate and magically tell you how many hours per week you will need to work. Remember this is the number of hours of lessons: don’t forget to allow time for admin and travel.

You can download this spreadsheet for free.

Upgraded Version

You may also wish to take your forecast further. With this upgraded version you can factor in much more:

- Holiday weeks from your franchise and car lease payments

- Additional income sources such as pensions, partner’s wages, state benefits etc

- Forecast the effect of increasing your hourly rate!

This upgraded version is available to purchase and you will be able to download it straight away. If you can increase your hourly rate by £1, this might be the best £10 you spend.